Definition of Credit Insurance

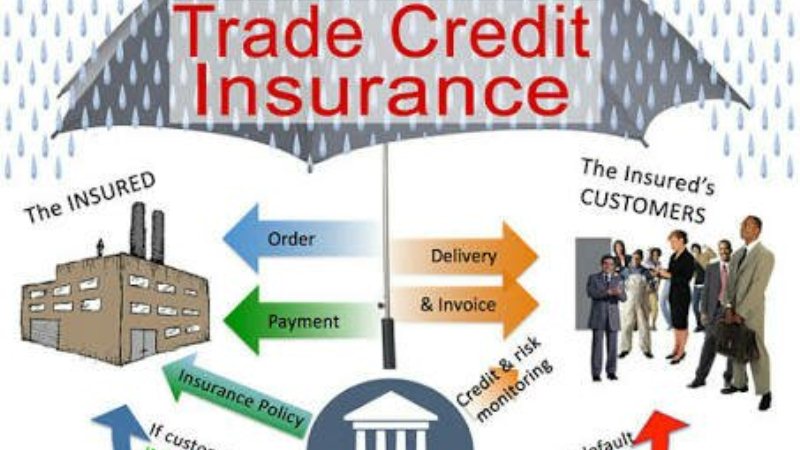

Credit insurance is a protection given insurance company (as underwriter) to the Bank, or finances financial institution (as insured) on the risk of failure of the Debtor in the credit facility or loan to pay cash (cash loan) as working capital loans, trade credits and other provided by the Bank, or finances financing institution.

About Credit Insurance

Credit insurance at first better known in the insurance environment in the form of protection to creditors against the risk of breakdown of the remaining repayment of loans due to death of the debtor. This insurance is also known by the term credit life insurance (credit life insurance); type of insurance business related to the life and death of a person should be treated by life insurance companies and not by insurance losses (general insurers).

Credit Guarantee. The term Should Be distinguished from insurance guarantee (insurance) Because of the characteristics the between the two different businesses. In insurance there are only 2 (two) parties INVOLVED i.e. the Insurer and the insured, while in underwriting there are 3 (three) sides of Oblige, Principal, and the Bank or Surety Company. Other differences the between insurance and assurance Is that in insurance, risk faced is in the form of accidental risk and more on natural risks Such as fires, Floods, Earthquakes, etc., While in underwriting, risk morals are facing more risk, Such as inability to pay the mortgage loan from a debtor to a creditor (credit crunch). Thus, the main purpose of insurance is to indemnify the insured in case of disaster from the outside, while the purpose of underwriting is to meet the reliability needs of the borrower.

Credit insurance as one of the financial guarantee products, thus is a type of guarantee Issued by a guarantor institution, either a bank or insurance, for the sake of doing wan oblige if the principal achievements. Usually if the services of banks, the principal must provide collateral or guarantees, either in the form of movable or immovable. Meanwhile, if you want to use insurance services, the principal is usually no need to provide collateral but enough compensation to sign the surety agreement (general agreement of indemnity to surety). This form is more commonly known as the surety ship. So the between the bank guarantee and surety bond is almost the same. Both aim to Provide a guarantee of principal employment to the oblige Bulkemailsoft.com. Usually the bank guarantee, warranty liquefaction can be done at the request of oblige without having to wait for proof of the failure on the part of principal. While the surety bond, claims can only be liquidated if it is proved that the principal has failed or employee achievements.

Credit Guarantee Insurance

Credit guarantee insurance is basically a combined form of credit insurance and credit guarantee the type of insurance cover in the debtor’s inability to pay off the remaining loan to the lender as a result of risks: (1) death (2) breach of contract. The mechanism of insurance runs in the event of death of the debtor, while guarantees will play a role in the event of non-death claim.

Conclusion. By looking at the fact That there are essential differences the between credit insurance and credit guarantee insurance credit insurance terms it Should Be first converted into credit guarantee insurance if Such provision would indeed aimed at the general insurance business entity / loss. That states the credit insurance is general insurance business lines Warranties That Provide financial obligation if the recipient credit loan recipient is Unable to meet its obligations under loan agreements.

Characteristically credit insurance is also a bi-party agreement between the Bank, and finances financing institutions with insurance companies. In this case the debtor does not include the parties to the agreement on the outstanding loans insured bank or financial institution financing to the Debtor.

In credit insurance the insured is a Bank or Financial Institution requesting financing credit insurance is not the debtor who borrowed funds from the Bank, or the Financial Institution Financing. Thus, credit insurance is a bi-party agreement where there are only two parties involved as an underwriter of the insurance companies and banks, or finance as an insured financial institution. Whereas the object of insurance coverage on credit is the risk of losses suffered by the Bank or Financial Institution Financing because of bad debts from the debtor.

Insurance companies that can do the guarantee are an insurance company licensed to conduct insurance underwriting credit from the Treasury.

Documents that must be met by the prospective insured in credit insurance filings

Bank or Financial Institutions who filed insurance Financing credit must submit the following documents to the prospective insurer:

- Cooperation Agreement or the Letter of Agreement between the Company and the Bank Insurance as an Underwriter or Finance Financing Agency as the insured.

- Lending Manual published by the Bank, or the Financial Institution Financing

- Deed of the debtor company, company profile debtor, and debtor’s financial statements last 3 years

- Copy / copies of credit applications from debtors to commercial banks / financial institutions, credit

- Approval memorandum from commercial banks / financial institutions to borrowers.

Credit insurance product is classified as follows:

Insurance on Loans Cash (Cash Loan)

- Working Capital Loan Insurance – Granted by Banks

- Export Working Capital Loan Insurance – Granted by Banks to export activities

Guarantee of Loans No Cash (Non-Cash Loan)

- Guarantee Opening L / C Import – Guarantees provided by insurance companies to the Bank Opening L / C Import for the benefit of the Applicant in case of default of payment L / C Import (payment default).

- Guarantee Opening – Guarantees provided by insurance companies to the Bank Opener (Letter of Credit undocumented Domestic / Import L / C) for the benefit of the applicant in case of default of payment (payment Default).

- Repeat Guarantee Bank Guarantee (Counter Guarantee) Insurance company guarantees given to Bank Issuer of Bank Guarantee for the benefit of the customer (Debtor) if the customer experience of default.

Risks that can be secured on credit insurance

Risks that can be secured on credit insurance are a risk that arises due to:

- Debtor does not pay off the loan at the time of loan maturity is concerned with the provisions of the Debtor is not there / not running anymore.

- Debtor stated in insolvent circumstances and therefore must meet one of the following things: Debtor declared bankrupt by the District Court authorized; 2. Debtor subject to liquidation by the competent court decisions and for it has been appointed Liquidator; 3. Debtor, not along the legal entity placed under remission.

- Debtor’s escape / disappear / are no longer known address

- The occurrence of withdrawal of credit before the loan period ends that is specific to loans with Maturities of more than 2 (two) years, provided that the withdrawal of the loan meets one of the Following provisions: 1. Intended to prevent or reduce the occurrence of greater losses if the credit was continued; 2. Due to discrepancies or deviations taken by the debtor of the provisions of the credit Agreement.

- Other risks are agreed between the insured and the insurer as outlined in the Cooperation Agreement or The Letter of Agreement

Risks that cannot be guaranteed on credit insurance

Risks that are not guaranteed on credit insurance are a risk that arises due to:

- Nuclear reactions, radioactive touch, radiation and reactions of atomic nuclei that are directly or Indirectly affect and lead to business failure Debtor Bank regardless of how and where the occurrence

- Losses suffered by Debtor caused by risks that must be closed in Loss Insurance coverage with full Marks (fully insured) or at least equal to the principal loan.

- The occurrence of one of the political risks that are directly or indirectly affect and lead to failure of Business debtors to pay off the Credit

- Legal action taken by the Government against the Debtor and the Debtor or business that directly or Indirectly affect the Debtor Bank and the result cannot be / able to pay off her credit.

- Natural disasters (Act of God)

- Due to errors / omissions committed by the Bank / Financial Institution Financing

Procedures for implementing the right of subrogation by the insurer

In terms of implementation of the rights of subrogation, the insurer pays a claim to the insured, the insurer will work with the insured to complete the sale of the debtor’s assets are to be credit guarantees. Insurers get guaranteed sales results for the value of claims paid to the insured.

After all the things that we know of credit insurance, there are still many other things that we have not fully discussed here. This is a fraction of credit insurance, we hope this little article can be a source of your knowledge of credit insurance can be beneficial and more. Of all the things we have learned about insurance, insurance may be our first choice to invest in the future, because insurance is a long-term investment of mutual benefit between the two sides.

Trade credit insurance, business credit insurance, export credit insurance or credit insurance.