There is not an iota of doubt that life insurance structures a vital part of our lives in recent times. You and the members of your family are secured in an additional way when you take an Insurance. Such life insurance policies will protect your family even in your absence meaning when you are no more.

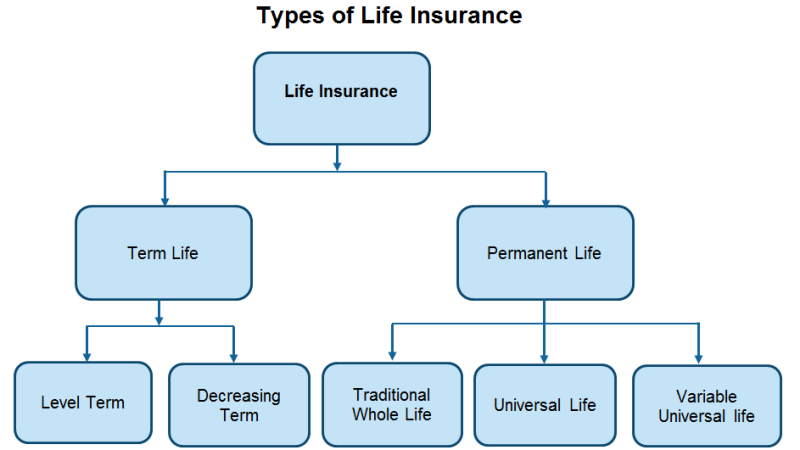

Types of Life Insurance

In an earlier post, we have already written about the basics of life insurance. In this article, we have listed the types of life insurance. For your convenience, a few of the largely preferred life insurance policies are as follows:

Term Insurance

These policies are only for a permanent term or fixed duration so as to insure members of family and dependents should there occur a premature death of the policy owner. Term Life Insurance Policies are the most uncomplicated and cheap as well because the premium you disburse is very less. This policy is best suited for those who do not want to spend a lot of money but at the same time, derive some benefits from insuring their life. The coverage in this plan is provided only for a limited period and they are normally obtainable for 30, 20, 15, 10 or 5 years.

Life Insurance With Investment

These are well known as Unit Linked Insurance Plans or ULIP, offering double advantage, that is, you get the benefits of indemnity in addition to reciprocal benefits. Actually under this plan a certain amount of your plan is invested in debt funds, bonds or even in equities, while the amount remaining is used to cover your life. The most important alluring point with regard to this plan is that you get tax benefits on these policies. Bear in mind that you will also have to be prepared for some risks linked to stock market.

Pension plans

India consists of a mushrooming elderly population with the most of them not having any or having, but, insignificant access to any kind of retirement provisos. Thus if you want to be happy and respected even after you retire then you must have a very excellent insurance policy. Under this policy the holder needs to pay premiums for some years so as to receive annuity in subsequent years. Pension plans are not only for old people but anyone who want to secure their life on a long term basis can go in for such plans.

Endowment Insurance Policies

Endowment Insurance Policies are the most excellent saving plans that allow for certain amount when the specific term for which the policy has been taken or on the event of death of the policy holder. After maturity of the policy the buyer will get additional gains like profits and bonuses.

Money-Back Plan

For those who seek both insurance coverage as well as investing, money-back policy is the apt one. It is perfect for the traditional investors who seek financial instruments that provide insurance as well as investment, but with low risk and guaranteed returns.

These were the most common types of Life Insurance Plans. If you feel that we have missed anything, or have any comments then please let us know.